We Help Make It Right, Bursa MarketPlace Fair

SIDREC recently participated in the Marketplace Fair held at BURSA on 9th to 10th January 2016.

Kuala Lumpur: The Securities Industry Dispute Resolution Center (SIDREC) recently expanded its purview, allowing it to offer its services to investors and capital markets services providers with disputes relating to claims exceeding RM250,000. The new service, being a voluntary scheme, requires both parties to a dispute to agree to use SIDREC’s alternative dispute resolution (ADR) services. ADR refers to dispute resolution outside the courts.

This is unlike the mandatory scheme, which obliges capital markets services providers to participate in SIDREC’s ADR process, if an investor submits a claim to SIDREC, of RM250,000 and under. The mandatory scheme continues to be a key part of SIDREC’s services and will remain a priority for SIDREC in ensuring that the smaller investor always has access to redress.

SIDREC Chairman Dato’ Ranita Mohd Hussein told the SIDREC 8th Annual General Meeting (AGM) today that the expansion of purview implemented in 2017 was one of the initiatives SIDREC has taken to remain relevant to market developments and the needs of investors.

The AGM held at the Securities Commission Malaysia building today was attended by some 100 corporate representatives of SIDREC members and observers. SIDREC has 184 members comprising commercial banks, Islamic banks, investment banks, specified development financial organisations (DFIs), fund managers, stockbrokers, derivatives brokers, unit trust management companies, and Private Retirement Scheme providers and distributors.

Ranita clarified, “Under the voluntary scheme, both the claimant and member must agree to seek SIDREC’s help; lawyers are permitted into the dispute resolution process, and both parties are charged a reasonable fee for the service. With the inclusion of this component, SIDREC is a step closer to its aim of becoming a one stop centre for capital market related disputes.

“In the coming year, more effort will be made to ensure there is greater awareness of the availability of this voluntary route.

“This is a natural precursor to ongoing discussions between SIDREC and Asian International Arbitration Centre’s proposed collaboration to provide for specialist capital market arbitration in the near future.”

“SIDREC has also positioned itself to provide mediation for cases referred to it by the courts within the Judiciary’s court referred mediation scheme,” said Ranita in her message in the SIDREC Annual Report 2017.

Ranita said SIDREC’s purview has over the last two years been incrementally expanded to reflect a more meaningful reach and accessibility. SIDREC was set up by the Securities Commission Malaysia as part of its investor protection framework. Its first members were Capital Markets and Services licence holders.

“SIDREC’s membership now includes commercial banks and Islamic banks as well as specified Development Financial Institutions. In light of the fact that the breadth of the distribution network for capital market products cuts across Capital Markets and Services License holders to include commercial banks and Islamic banks, the expanded purview means that investors in capital market products are able to access SIDREC’s services no matter where the point of transaction or sale took place.

“Based on our statistics in 2017, 22% of the eligible claims registered in SIDREC relate to investments transacted with commercial and Islamic banks, and DFIs. We will continue to work with the regulators to ensure our purview remains relevant to developments in the market and regulatory framework.”

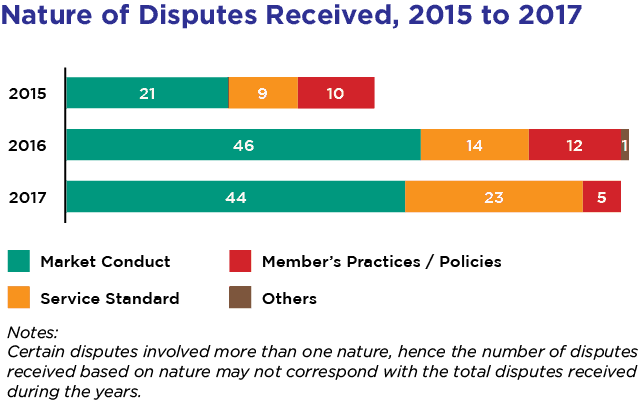

SIDREC reported receiving a total of 628 claims and enquiries in 2017, comprising 72 eligible disputes, 75 ineligible disputes and 481 enquiries. Market conduct continued to be the leading issue in 2017 (as it was in 2016), making up 61.1% (44 out of 72 eligible disputes) of total eligible disputes received in 2017. Of the disputes handled in 2017, 91.2% were resolved through case management or mediation.

SIDREC’s CEO Sujatha Sekhar Naik noted that SIDREC also has a role in contributing to market discipline and improving the overall standards in the capital market.

“Parties always leave the table with an understanding of what caused the dispute and steps that could have been taken to avoid a repeat of the same. In this way dispute resolution bodies can act as an effective ‘nudge’ towards better or more responsible and ethical behaviour and habits. This supports members own risk management and efforts to instill self-discipline and ethical practices, on the part of both the member and the investor claimants.”

Background

The three main types of claims received by SIDREC, as well as examples of specific issues that fall under each category are:

Market Conduct (44 cases or 61.1% of eligible disputes) including • Fraud / defalcation / misappropriation • Sales practices (includes mis-selling, bad advice, product suitability, inadequate disclosures) • Unauthorised transactions / non-compliance with instructions

Service Standard (23 cases or 31.9% of eligible disputes) • Delays / errors / glitches in online system • Delays / errors / lapses in disclosure • Other delays / errors in process

Member’s Practices/ Policies (5 cases or 6.9% of eligible disputes) • Fees and charges • Disclosure policy • Product development and sales policy

SIDREC’s annual report stated that the acceptance of cash for transactions was a continuing issue in 2017. Despite warnings to investors in prospectuses, application forms, and statements, not to pay cash to agents, many investors still give cash to agents of the intermediaries, thus there is still a need for focused awareness efforts by members and all stakeholders to educate the general public.

Out of the 44 disputes relating to market conduct issues in 2017, 12 involved sales practices (e.g. mis-selling, bad advice, product suitability, inadequate disclosure).

Sales practices remained a continuing issue, although the number had dropped from 18 disputes in 2016 to 12 disputes in 2017. Product distributors play an integral part in ensuring that there are relevant policies and processes in place that reflect ethical sales and disclosure practices.

The report stated: “We note that product distributors could do more by ensuring that their representatives or agents make more effort to better explain the features of the products to their clients, as investment products are becoming increasingly complex. Explanations should not solely focus on potential returns of investments, but also include explanations on the risks of such investments, as well as all the relevant fees and charges involved.”

The number of disputes relating to service standards has gone up the most compared to other disputes, from 14 in 2016 to 23 in 2017.

“The increase was mainly contributed by a rise in the number of disputes relating to delays, errors or glitches in online systems. This could be partly due to the increased usage of online trading platforms provided by the members,” the report stated. The full annual report (.pdf) is available here.

Click here to download this media release.

About SIDREC SIDREC is an independent alternative dispute resolution body for the capital markets. It was set up by the Securities Commission Malaysia as part of its investor protection framework. SIDREC seeks to help investors and capital markets products and services providers resolve monetary disputes that they cannot resolve on their own by providing an expert, independent and impartial alternative dispute resolution avenue via mediation and adjudication. Its service is free for investors for claims up to RM250,000. More details: sidrec.com.my

Related Articles:

SIDREC recently participated in the Marketplace Fair held at BURSA on 9th to 10th January 2016.

Kuala Lumpur: The Securities Industry Dispute Resolution Center (SIDREC) recently expanded its purview, allowing it to offer its services to investors and capital markets services providers with disputes relating to claims exceeding RM250,000.

The Securities Industry Dispute Resolution Center (SIDREC), which begins operations today, aims to resolve small claims disputes in an efficient and timely manner – within 90 days upon receipt of complete documentation.

Securities Industry Dispute Resolution Center (201001025669)

Unit A-9-1, Level 9, Tower A

Menara UOA Bangsar

No. 5, Jalan Bangsar Utama 1

59000 Kuala Lumpur

T: +60-3-2282 2280

F: +60-3-2282 3855

E: info@sidrec.com.my