SIDREC to Speak on How SIDREC Can Help You at InvestSmart Day 2018 on 7 July

Join SIDREC at Securities Commission Malaysia’s InvestSmart Day 2018, and catch up with our Case Manager Jelisa Tan, as she shares insights on how SIDREC can help you.

The Securities Industry Dispute Resolution Center (SIDREC) has released its 2022 Annual Report. It emphasises the organisation’s commitment to providing impartial and effective dispute resolution services for individual investors in Malaysia.

SIDREC offers mediation and adjudication as alternative dispute resolution services to resolve capital market-related monetary disputes, enabling investors to seek redress without the need for legal action.

Protecting Individual Investors through Robust and Impartial Dispute Resolution

In 2022, SIDREC received a total of 239 claims and enquiries, comprising 72 eligible disputes and 167 enquiries. This represents a 53% increase in the number of eligible disputes received from the previous year. In 2021, SIDREC received a total of 275 claims and enquiries, comprising 47 eligible disputes and 228 enquiries. Since its inception in 2011, SIDREC has received a total of 3,426 claims and enquiries, comprising 660 eligible disputes and 2,766 enquiries.

SIDREC’s Chairman, Dato’ Mah Weng Kwai, stated in the report that “Beyond a comparison of the number of disputes referred to SIDREC, what is significant is the big difference in the quantum of claims. Since SIDREC’s inception, this has ranged from as low as RM10 to over RM1 million. This varied difference in value demonstrates the robustness and neutrality of SIDREC’s mandate that allows for all retail investors to access its redress mechanism regardless of the claim amount as long as they meet the eligibility criteria.”

SIDREC’s Chief Executive Officer, Ms Sharmila Sharma, explained in the report that “The 53% increase in eligible disputes received in 2022 is attributed to the rise in unit trust and structured product related disputes. Additionally, SIDREC’s increased efforts to raise awareness of its dispute resolution services and the growing recognition among stakeholders of its role in the capital market and the services it offers may have also contributed to the increase.”

Court Recognition, a SIDREC Milestone

In 2022, in another key milestone for the organisation, SIDREC was included as one of the institutions listed in the Arahan Amalan Ketua Hakim Negara Bilangan 2 Tahun 2022 as a provider of mediation services. This recognition and inclusion of SIDREC by the Courts further expands its reach to the investing public as SIDREC facilitates the resolution of capital market related monetary disputes through mediation as part of the nation’s overall investor protection infrastructure.

For more details and insights, please refer to SIDREC’s Annual Report 2022 available online at www.sidrec.com.my.

Securities Industry Dispute Resolution Center

27 March 2023

About SIDREC

SIDREC is a body approved by the Securities Commission Malaysia (SC) to handle capital market-related monetary disputes between individuals or sole proprietors and providers of capital market products and services who are SIDREC Members. SIDREC Members include banks, stockbrokers, unit trust management companies, fund managers and private retirement scheme providers and distributors.

SIDREC works with investors and capital market providers of products and services who have eligible disputes related to investments to provide case management, mediation and adjudication services to both parties to achieve a resolution in an independent, impartial and effective manner.

Under its Mandatory Scheme, SIDREC’s dispute resolution services are free for investors with monetary claims not exceeding RM250,000.

Under its Voluntary Scheme, SIDREC accepts disputes involving monetary claims exceeding RM250,000 provided both parties agree to use SIDREC’s services.

Nature of Eligible Disputes

SIDREC classifies eligible disputes according to the issues raised. The following are the three main categories of eligible disputes, including some examples of issues that fall under each category:

Related articles:

Join SIDREC at Securities Commission Malaysia’s InvestSmart Day 2018, and catch up with our Case Manager Jelisa Tan, as she shares insights on how SIDREC can help you.

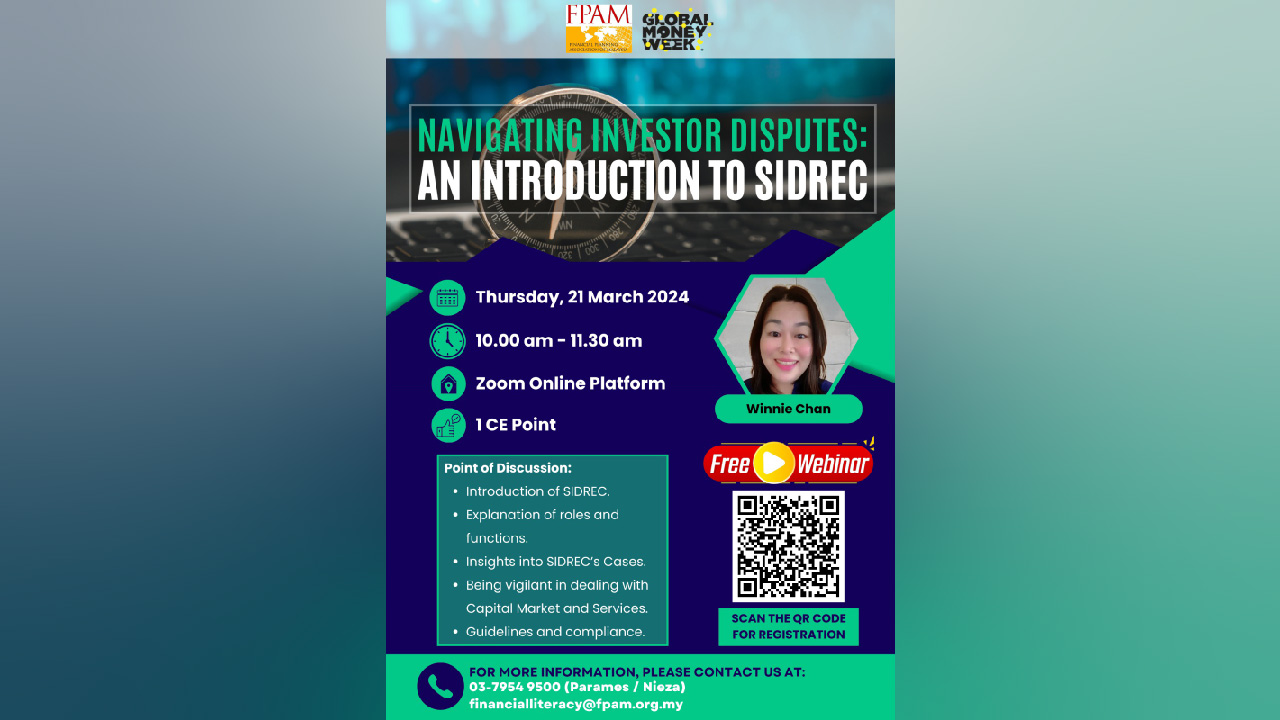

Don’t miss our upcoming free online webinar where we will delve into Navigating Investor Disputes: An Introduction to SIDREC in conjunction with the Global Money

SIDREC CEO Sujatha Sekhar Naik and head of dispute resolution Hong Siew Lai was featured on Money Money Home, a financial literacy programme on Astro AEC on 9 April 2017.

Securities Industry Dispute Resolution Center (201001025669)

Unit A-9-1, Level 9, Tower A

Menara UOA Bangsar

No. 5, Jalan Bangsar Utama 1

59000 Kuala Lumpur

T: +60-3-2282 2280

F: +60-3-2282 3855

E: info@sidrec.com.my